What Is Autocorrelation?

Autocorrelation is a statistical representation of the degree of correlation between the same variables measured at successive time intervals. Correlation indicates the strength of a linear relationship between two variables. Whereas, autocorrelation measures the strength of a linear link between time series lagged values. It measures the degree of similarity between a particular time series and a lagged version over subsequent time intervals. Autocorrelation is theoretically similar to the correlation between two different time series. However, it employs the same time series twice. Once, in its original form and once lagged by one or more time periods.

Autocorrelation is a statistical representation of the degree of correlation between the same variables measured at successive time intervals. Correlation indicates the strength of a linear relationship between two variables. Whereas, autocorrelation measures the strength of a linear link between time series lagged values. It measures the degree of similarity between a particular time series and a lagged version over subsequent time intervals. Autocorrelation is theoretically similar to the correlation between two different time series. However, it employs the same time series twice. Once, in its original form and once lagged by one or more time periods.

Consider a pattern in a series of numbers. Moreover, the values in the series can be predicted based on previous values in the series. In that case, the series of numbers is said to display autocorrelation. This is also referred to as serial correlation and serial dependence. The auto component of autocorrelation comes from the Greek word for self. Therefore, autocorrelation refers to data that is associated with itself rather than with other data. When it comes to investment, a stock may have a large positive autocorrelation in its returns. This implies that if it is “up” today, it is more likely to be “up” tomorrow as well. Naturally, autocorrelation can be a beneficial tool for traders, especially technical analysts.

Autocorrelation – A Closer Look

Autocorrelation is also known as lagged correlation or serial correlation. This is because it analyses the link between a variable’s current value and its historical values. When calculating the degree of correlation, the result can range from -1 to +1.

- +1 correlation – indicates a perfect positive correlation. An increase seen in one time series leads to a proportionate increase in the other time series.

- -1 correlation – implies a perfect negative correlation. An increase that is seen in one-time series results in a proportionate decrease in the other time series.

Autocorrelation measures linear relationships. Even if the autocorrelation is negligible, a nonlinear relationship can exist between a time series and a delayed version of itself. For example, the air temperature on the first day of April should be more similar to the temperature on the second day than to the temperature on the 30th day. The data would be autocorrelated if the temperature values that occurred closer together in time were more comparable than the temperature values that occurred farther apart in time.

The Durbin-Watson Test

The Durbin-Watson test is the most commonly used way of testing for autocorrelation. In short, it is a statistical method to detect autocorrelation in a regression study. The Durbin-Watson always yields a test result between 0 and 4. Values closer to 0 imply a more positive correlation. On the other hand, values closer to 4 indicate more negative autocorrelation. Values closer to the center indicate less autocorrelation.

Autocorrelation – Technical Analysis in Financial Markets

The significance of autocorrelation can be seen in financial markets. Autocorrelation can be used to thoroughly analyze historical market movements. Potentially, this allows investors to forecast future price fluctuations. In particular, it can be utilized to establish whether a momentum trading strategy makes sense.

This is because technical analysis is chiefly concerned with the trends of, and linkages between, securities prices. As a result, utilizing charting techniques can be valuable. Autocorrelation can be used by technical analysts to determine how much influence the historical prices of a stock or investment have on its future price. Moreover, autocorrelation can help determine if there is a momentum factor at play with a given stock. For example, consider a stock with a high positive autocorrelation that has two consecutive days of significant gains. In that case, it may be realistic to predict the stock to rise over the next two days as well.

Example of Autocorrelation in Stock Trading

Autocorrelation analysis can be used in conjunction with momentum factor analysis. A technical analyst can discover how the stock price of a given day is affected by the price of previous days. As a result, he can forecast how the price will go in the future. If the price of a stock with substantial positive autocorrelation has been rising for several days, the analyst can credibly predict that the price will rise more in the next few days. To profit from the rising price movement, the analyst may buy and hold the stock for a limited length of time.

For example, assume DayTradrr wants to know if a stock in its portfolio shows autocorrelation in its returns. This means the stock’s returns are related to its returns in previous trading sessions. DayTradrr may classify it as a momentum stock if the returns show autocorrelation. This would be the case if past returns appear to impact future returns. DayTradrr does a regression with the return from the previous trading sessions as the independent variable. The regression is repeated for the current return as the dependent variable. As a result, DayTradrr discovers that one-day prior returns have a positive autocorrelation of 0.85.

The result of 0.85 is near +1. Therefore, historical returns appear to be a very good predictor of future returns for this specific stock. As a result, DayTradrr might look to capitalize on autocorrelation or momentum. DayTradrr can do this by holding its position or buying more shares.

Autocorrelation analysis primarily provides information about short-term trends and says little about a company’s fundamentals. Fundamental analysis focuses instead on a company’s financial health or management. As a result, correlation can only be used to back trades with limited holding periods.

Autocorrelation and Global Positioning Systems

Autocorrelation is also one of the key mathematical approaches used in the GPS chip. These are found in smartphones and other mobile devices. In this case, autocorrelation is employed to compensate for propagation delay. That is the time difference between when a carrier signal is delivered and when it is finally received by the GPS device in question. This is how the GPS knows where you are at all times. Also, how it tells you when and where to turn shortly before you arrive at your destination.

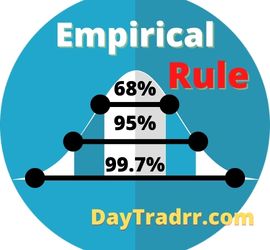

Up Next: What Is the Empirical Rule?

The Empirical Rule states that virtually all observed data for a normal distribution will fall within three standard deviations of the mean or average. The empirical rule is also known as the three-sigma rule or the 68-95-99.7 rule. It is a statistical axiom stating that with a normal distribution, almost all observed data will lie within three standard deviations of the mean or average. The empirical rule predicts that 68 percent of observations will fall within the first standard deviation, 95 percent will fall within the first two standard deviations, and 99.7 percent will fall within the first three standard deviations.

The Empirical Rule states that virtually all observed data for a normal distribution will fall within three standard deviations of the mean or average. The empirical rule is also known as the three-sigma rule or the 68-95-99.7 rule. It is a statistical axiom stating that with a normal distribution, almost all observed data will lie within three standard deviations of the mean or average. The empirical rule predicts that 68 percent of observations will fall within the first standard deviation, 95 percent will fall within the first two standard deviations, and 99.7 percent will fall within the first three standard deviations.

When you reasonably expect your data to approximate a normal distribution, the mean and standard deviation become especially helpful. Knowing just these two statistics allows you to determine probabilities and percentages for a variety of possibilities. The empirical rule gets its name from empirical research. As a result, it relies on observations and measurements of real-world outcomes rather than theory. In other words, empirical implies the rule is anchored in real-world experience. The empirical rule takes recorded events and allows you to forecast and calculate probability based on them. The axiom is also known as the three-sigma rule by statisticians. This is because practically all observations fall within three standard deviations. This rule establishes the upper and lower bounds of a statistical control chart at plus or minus three standard deviations. Also, this limit is useful for identifying outliers because 99.7 percent of all data should fall within it.