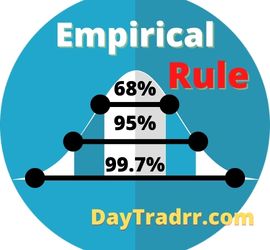

What Is the Empirical Rule?

The Empirical Rule states that virtually all observed data for a normal distribution will fall within three standard deviations of the mean or average. The empirical rule is also known as the three-sigma rule or the 68-95-99.7 rule. It is a statistical axiom stating that with a normal distribution, almost all observed data will lie within three standard deviations of the mean or average. The empirical rule predicts that 68 percent of observations will fall within the first standard deviation, 95 percent will fall within the first two standard deviations, and 99.7 percent will fall within the first three standard deviations.

The Empirical Rule states that virtually all observed data for a normal distribution will fall within three standard deviations of the mean or average. The empirical rule is also known as the three-sigma rule or the 68-95-99.7 rule. It is a statistical axiom stating that with a normal distribution, almost all observed data will lie within three standard deviations of the mean or average. The empirical rule predicts that 68 percent of observations will fall within the first standard deviation, 95 percent will fall within the first two standard deviations, and 99.7 percent will fall within the first three standard deviations.

When you reasonably expect your data to approximate a normal distribution, the mean and standard deviation become especially helpful. Knowing just these two statistics allows you to determine probabilities and percentages for a variety of possibilities. The empirical rule gets its name from empirical research. As a result, it relies on observations and measurements of real-world outcomes rather than theory. In other words, empirical implies the rule is anchored in real-world experience. The empirical rule takes recorded events and allows you to forecast and calculate probability based on them. The axiom is also known as the three-sigma rule by statisticians. This is because practically all observations fall within three standard deviations. This rule establishes the upper and lower bounds of a statistical control chart at plus or minus three standard deviations. Also, this limit is useful for identifying outliers because 99.7 percent of all data should fall within it.

A Closer Look at the Empirical Rule

In statistics, the empirical rule is frequently used to forecast final outcomes. This method can be used as a preliminary estimate of the outcome of the upcoming data to be collected. Once the standard deviation is calculated an estimate can be derived, even before gathering exact data. Acquiring the necessary data may be time-consuming or even impossible in some circumstances. Therefore, the probability distribution might be used as an intermediate estimate. Such concerns come into play when a company examines its quality control systems or assesses its risk exposure. For example, consider the widely used risk tool known as value-at-risk (VaR). It assumes that the probability of risk events follows a normal distribution.

The empirical rule is sometimes used to test if a distribution is, in fact, normal. For example, when a large number of data points fall outside the three standard deviation bounds. That indicates that the distribution is not normal and might either be skewed or follow another distribution. The empirical rule is also known as the three-sigma rule. The term three-sigma refers to a statistical distribution of data. Moreover, that data is within three standard deviations of the mean on a normal distribution bell curve.

What Does the Empirical Rule Tell You?

Analysts employ the empirical rule to forecast the probabilities and distributions of the outcomes under consideration. It’s a useful tool because it allows you to generate predictions using a variety of simple statistics. For example, you can check to see if your data follow a normal distribution, at least roughly. If so, you can begin forecasting by computing the mean and standard deviation.

Many organizations employ the empirical rule as a quality control tool. This is because many variables can be confidently expected to have a normal distribution. As a result, the mean and standard deviation are straightforward to determine. Similarly, the value-at-risk (VaR) financial risk assessment implies that outcome probabilities are normal. In short, the empirical rule is a simple and effective prediction strategy with solid, reliable results. Furthermore, the empirical rule is a simple method for identifying outliers. Analysts commonly utilize the limit of three standard deviations to identify outliers. This is because 99.7 percent of all observations should be within three standard deviations of the mean. Therefore, they can look at observations that fall outside of this range as potential outliers.

The Empirical Rule is a statistical concept that helps show the likelihood of observations. It is especially effective when approximating a large population. However, always keep in mind that these are only estimations. Outliers who do not fit into the distribution are always a possibility. As a result, the findings are incorrect, and you should proceed with caution if you rely on the projection.

Empirical Rule – Example

The axiom is commonly used to forecast a data set’s trend. When the data set is large, it becomes difficult to examine the complete population. Therefore, the Empirical Rule can be applied to a sample to provide an estimate of how the data in the entire population would react. For example, imagine you are asked to find the average income of all college professors in the United States. This is a challenging process to complete when the population set is quite large. However, you may choose, say, 90 observations at random from the total population.

Calculation

Once you have 90 salaries, you need to find the Mean and Standard Deviation of the observations. If the observation follows a normal distribution, then this can be applied. At this point, there is enough data to estimate the salary of all college professors in the US. Assume that the sample’s mean wage is $100,000. In addition, the standard deviation is $4,000. So, out of the whole population, 68 percent of college professors earn a wage that falls between plus or minus one standard deviation from the mean.

- 68% – The Mean is $100,000 and the Standard Deviation is $4,000. Therefore, 68 percent of all college professors in the United States are compensated in the $100,000 +/- (1*$4,000) range. That is between $96,000 and $104,000.

- 95% – Spreading the range a bit more, then 95% of all the college professors in the US are being paid in the range of Mean +/- 2 Standard Deviations. The calculation is $100,000 +/- (2*$4,000). Therefore, the range is $92,000 to $108,000.

- 99.7% – In a broader range, 99.7% of all accountants are drawing salaries ranging from Mean +/- 3 Standard Deviations. That is 100,000 +/- (3*$4,000). The range is $88,000 to $112,000.

You can readily see that population estimates can be obtained without researching the entire population. So, what if someone wants to work as a college professor in the United States? How much can he or she expect to earn? A college professor may expect to earn between $88,000 and $112,000. This type of estimation provides accurate results without the heavy lifting of canvassing an entire population.

Frequently Asked Questions

What Is the Empirical Rule?

In statistics, the empirical rule states that 99.7 percent of data in a normal distribution falls within three standard deviations of the mean. As a result, 68 percent of the observed data will fall within the first standard deviation. 95 percent will fall within the second standard deviation. And, 97.5 percent will fall within the third standard deviation. The empirical rule forecasts the probability distribution of a given set of outcomes.

How Is it commonly used?

As indicated, the empirical rule is very useful for forecasting outcomes within a data collection. Once the standard deviation has been determined, the data set may readily be subjected to the empirical rule. It shows where the bits of data belong in the distribution. Forecasting is possible because, even without knowing all of the data, accurate estimates may be made. For example, where the data will lie within the set, based on the 68 percent, 95 percent, and 99.7 percent guidelines that specify where all data should lay.

Most of the time, the empirical rule is used to assist and determine outcomes when not all of the data is accessible. It enables statisticians – or anyone analyzing the data – to predict where the data will fall once all of it is available. The empirical rule can also be used to determine how regular a data set is. If the data does not follow the empirical rule, the distribution is not normal and must be estimated accordingly.

Is the Empirical Rule useful in Finance?

The empirical rule is useful because it can be used to accurately estimate outcomes where all the data is not available. This is especially true for large datasets and those with uncertain variables. In finance, the empirical rule applies to stock prices, price indexes, and log values of currency rates. All of these tend to follow a bell curve or normal distribution.

Up Next: Series 63 – What Is A Series 63 License?

The Series 63 license is the Uniform Securities Agent license, which enables agents to sell securities in most of the 50 states in the U.S. To receive a Series 63 license, the applicant must pass an exam and be familiar with ethical practices and fiduciary responsibilities. Individuals who seek to offer securities in most states must pass the Series 63 or Series 66 examination, depending on their qualifications and other registration levels.

The Series 63 license is the Uniform Securities Agent license, which enables agents to sell securities in most of the 50 states in the U.S. To receive a Series 63 license, the applicant must pass an exam and be familiar with ethical practices and fiduciary responsibilities. Individuals who seek to offer securities in most states must pass the Series 63 or Series 66 examination, depending on their qualifications and other registration levels.

The Series 63 exam is called the Uniform Securities State Law Examination. It is a North American Securities Administrators Association (NASAA) exam administered by FINRA. The exam has 60 scored questions with a time limit of 75 minutes for candidates to complete the assessment. To pass the Series 63 exam, a candidate must properly answer at least 43 of the 60 scored questions.