What Is a Block Trade?

A block trade is an agreement between private parties to buy and sell a large number of financial securities outside public financial markets. As a result, block trades are large transactions arranged confidentially and conducted outside of public markets to reduce the impact on the price of the security. For example, hedge funds and institutional investors often conduct them through investment banks and other intermediaries. Also, high-net-worth accredited investors may be eligible to participate as well. A block trade is defined by the New York Stock Exchange and the Nasdaq as a transaction involving at least 10,000 shares of stock or a value of more than $200,000. In reality, the majority of block trades are much larger than these minimums.

A block trade is an agreement between private parties to buy and sell a large number of financial securities outside public financial markets. As a result, block trades are large transactions arranged confidentially and conducted outside of public markets to reduce the impact on the price of the security. For example, hedge funds and institutional investors often conduct them through investment banks and other intermediaries. Also, high-net-worth accredited investors may be eligible to participate as well. A block trade is defined by the New York Stock Exchange and the Nasdaq as a transaction involving at least 10,000 shares of stock or a value of more than $200,000. In reality, the majority of block trades are much larger than these minimums.

Block trading is normally reserved for institutional investors due to the sizeable number of shares that are purchased and sold in a single transaction. These significant transactions can use a private middleman, such as an investment bank or hedge fund, to facilitate the transaction. Block trades may be broken down and further transacted through a number of different middlemen for convenience and faster execution.

Block Trade – A Closer Look

A large-scale sell order made on a public stock exchange might have a disproportionate impact on the share price. However, a privately negotiated block trade will not alert other market players about the potential increased supply. At least, until the transaction is publicly disclosed and recorded. The nature of a huge order transaction is referred to as a block trade. Block transactions are often executed through a blockhouse. These are financial intermediaries dedicated to assisting investors with risk management. Block trading may be thought of as a mechanism for dealers to purchase and sell a large number of securities without affecting market pricing. As a result, specifically trained professionals in blockhouses may assist in the management of huge trade orders. The objective is to manage and execute large trade orders while maintaining the security’s price.

Block trading facilities and dedicated departments within brokerages operate through dark pools. These are private exchanges where large buy and sell orders can be matched out of public view. It facilitates initiating and completing massive deals without having a significant – and costly – influence on a stock’s or bond’s price. For example, blockhouses can break up large trades on public markets to conceal the scope of additional supply. This way, investors can block trade stock and sell their equities at an agreed date in one go. As a result, there should therefore be less risk of abrupt price movements.

Each of these dark pools is a non-public exchange service that operates according to its own set of regulations. However, they all have a network of hedge funds and other significant traders with whom they may buy and sell enormous blocks of securities. Blockhouses and dark pools connect these major buyers and sellers, allowing them to conduct sometimes massive deals without disturbing the markets.

Why Block Trading Exists

These deals are frequently so huge that they have the ability to shift the market for a particular security. For example, consider a pension fund manager who wants to sell a million shares of a specific stock. However, he wants to avoid causing a larger market selloff. As a result, selling all of those shares on the open market will take time. Also, during a public sell-off, the price of the shares will fall merely because of the sheer quantity they are selling.

If the fund manager moves slowly, it raises the possibility that other traders may notice the selling institution or fund. Those investors could then sell the stock short to profit from the sizeable offloading. The hazards are the same for a fund manager who buys huge blocks of stocks or securities on the open market. The purchase has the potential to raise the price. If the trade becomes well-known, other traders may tag along or front-run the purchases.

Is Block Trading Good or Bad?

Block trades are neither good nor bad. A block trade is not market manipulation, despite the fact that it can impact markets. Large investors regularly use them to modify their asset allocation with the least amount of market disruption and stock volatility. However, the institutional investors would not go to such pains to hide their block trading unless the information provided by a block trade was extremely important. A block trade can reveal valuable information regarding a security’s short-term future movement and liquidity. It might also suggest a shift in market attitude. However, determining what a block deal means might be difficult at times. A massive move that appears to be a huge adjustment for a popular stock might simply be a major mutual fund making a modest adjustment.

Facilitating a block trade is not for the faint of heart and presents sizeable risks. Things might go wrong for both the seller and the investment bank or broker that is assisting. The seller wants to act swiftly to take advantage of a current price before the block of shares is sold and drives it down. Conversely, investment banks attract business by proposing to buy the block outright. However, it leaves them with the dilemma of figuring out how to get rid of the block without losing money.

Block Trade – Regulations

Block trades not yet publicly disclosed are considered material non-public information. As a result, the financial industry’s self-regulatory organization, FINRA, prohibits the disclosure of such information as front running.

No member or person associated with a member shall cause to be executed an order to buy or sell a security or a related financial instrument when such member or person associated with a member causing such order to be executed has material, non-public market information concerning an imminent block transaction in that security, a related financial instrument or a security underlying the related financial instrument prior to the time information concerning the block transaction has been made publicly available or has otherwise become stale or obsolete. (Source: finra.org)

Block Trade vs Cross Trade

When a broker matches purchase and sell orders from two different parties for the same assets without recording the deal on an exchange, this is known as a cross-trade. The investor may not get the most out of their deal if the broker merely matches the two orders without correctly reporting the transaction. Despite the fact that a cross transaction performs similarly to block trade, it is a dubious approach. Some brokers regard it as a kind of price manipulation. As a result, many online trading platforms do not allow it to be used. Transferring assets across client accounts via a cross trade may be permissible in specific situations. For example, as long as the exchange is demonstrated to be beneficial to both parties and done at a fair market price.

This is why, for block transactions, investors frequently contact a blockhouse. It is the best available method to conduct massive trades. Further, it guarantees that they are taking advantage of the best pricing available in the market.

Block Trade Example

An institutional investor wants to sell 200,000 shares of a company near the current market price of $20. This is a four-million-dollar transaction on a company that is worth approximately two hundred million. The sale represents five percent of the total market capitalization. As a result, it would probably push down the price significantly if entered as a single market order. Also, the size of the order means it would be executed at progressively lower prices after exhausting demand at the $20 asking price. The institutional investor wants to avoid complications. He is willing to let the block go at a discount in order to offload the block quickly in one go.

So, the institutional investor contacts a blockhouse to help with the trade. Blockhouse staffers can break up the large trade into manageable chunks. For example, they might purchase the entire block at $18.50 per share. Next, they would split the block trade into 50 offers of 4,000 shares. Each offer would be posted by a different broker to further disguise its origin. Alternatively, the blockhouse could find a buyer willing to buy all 200,000 shares at $19.25 per share arranged outside the open market. This would typically be another institutional investor.

Up Next: What is a Reverse Head And Shoulders Pattern?

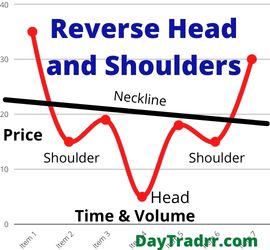

A reverse head and shoulders pattern is a technical charting indicator associated with a bullish, upward reversal of a downward price trend.

A reverse head and shoulders pattern is a technical charting indicator associated with a bullish, upward reversal of a downward price trend.

The reverse head and shoulders pattern is also known as a head and shoulders bottom. The formation is similar to the standard head and shoulders pattern, but inverted. The head and shoulders top is used to predict reversals in downtrends. Conversely, the head and shoulders bottom is used to predict reversals in uptrends. When a security’s price action fits the following criteria, this pattern is identified. First, the price falls to a trough and then rises. However, the price falls below the earlier trough yet to rise again. Finally, the price falls but not as far as the second trough. Following the completion of the final dip, the price begins to rise, aiming for resistance at the tops of the prior troughs.