What Is Functional Obsolescence?

Functional obsolescence is when an asset becomes less useful because of an outdated design that cannot be readily renovated or modernized. It is the reduction of an object’s usefulness or desirability because of an outdated design feature that is difficult to change or update.

Functional obsolescence is when an asset becomes less useful because of an outdated design that cannot be readily renovated or modernized. It is the reduction of an object’s usefulness or desirability because of an outdated design feature that is difficult to change or update.

The application of the term varies based on industry. In real estate, it refers to the loss of property value due to obsolete features. For example, an older house with one bathroom in a neighborhood filled with new homes that have two bathrooms or more. It may also refer to outdated technologies. The iPhone made older versions of mobile phones obsolete. New and faster computer processors make older, slower versions obsolete.

- Obsolescence risk – Companies must constantly upgrade their processes, products, and technologies or face obsolescence risk. It occurs when a company falls behind competitors with functionally obsolete offerings. As a result, they can no longer be competitive in the marketplace.

- Planned obsolescence – is a strategy of deliberately ensuring that the current version of a given product will become out of date or useless within a known time period. In some cases, companies actively put policies in place to make products functionally obsolete. For instance, Apple Inc. has been criticized for not maintaining updates and customer service for older, outdated iPhones and other devices. By refusing support or updates for older models, Apple is accelerating the functional obsolescence of its older product offerings.

Functional Obsolescence – A Closer Look

Consumer electronics

New technologies are constantly introduced in the consumer electronics industry. As a result, the regular introduction of newer, improved versions, yields shorter lifespans before many products are obsolete. Carefully evaluating the long-term utility of purchased goods is essential to limit losses caused by functional obsolescence. An otherwise useful item can become unappealing if its design doesn’t upgrades or compatibility with other devices.

For example, prior to the late 1990s, most houses had massive, heavy tube televisions. Large consoles and entertainment centers were built to fit their weight and size. Today, most homes have low-profile flat-screen televisions. This makes the previous entertainment centers virtually obsolete. Furniture makers frequently alter their goods to keep up with technological improvements in consumer electronics. Another example of functional obsolescence is the continuously changing parade of smartphones. With the advancement of smartphone technology, new cellphones can perform more and incorporate more capabilities. This renders older models essentially outdated long before the break or quit working.

Depreciating business assets

In the business world, long-term company planning takes functional obsolescence into account. For example, companies account for functional obsolescence through asset depreciation on their balance sheets. There are a variety of accounting methods available and approved by tax authorities to calculate an asset’s depreciation. However, the overall goal is to measure and track an asset’s declining usefulness and value over time. This business planning strategy also assists organizations in anticipating the need to sell and repurchase new assets.

Functional Obsolescence – Real Estate

In general, functional obsolescence occurs when an asset’s usefulness is decreased. This can occur when the design or materials used no longer meet the demands or needs of its users.

In real estate, functional obsolescence usually leads to a loss of consumer appeal resulting in lower appraisal values. Real estate can be functionally obsolete if its design features are outdated, not useful, or not aligned with market tastes and standards. This often occurs when an older house is located within a neighborhood of new homes. Functional obsolescence is generally associated with rundown structures in neglected neighborhoods. However, it can also occur to the other extreme. For example, a home may be over-built and over-improved. In that case, a homeowner renovates and includes features that might not be necessary or appreciated. The real estate industry makes efforts to objectively quantify the effect of functional obsolescence. However, assessment or appraisal of functional obsolescence is mostly subjective. Many factors contribute to the ultimate value a home provides. Ultimately, it can come down to the taste and preference of the potential new owner.

Real estate and its functional capacity are influenced by changes in market tastes and/or standards. A property can become functionally obsolete when its design, style, amenities, or technology no longer meet the needs and/or expectations of modern tenants. Modern tenants require high-speed internet connections, strong cellular reception, advanced security features, and modern audio/video capabilities. Office buildings require videoconferencing and high-speed internet connectivity. Properties that do not have these features are modern examples of functional obsolescence. In some cases, the solution is met through upgrades and renovations. In other cases, solutions are difficult and not easily implemented.

Types of Functional Obsolescence in Real Estate

Functional obsolescence is most likely to occur in one of three ways.

- Incurable functional obsolescence – This form of functional obsolescence—sometimes called external obsolescence or economic obsolescence—occurs when the remedies needed to increase a property’s value are outside of your control. For example, there’s no way to remedy the location of a home situated on the corner of a busy intersection. Incurable obsolescence can also apply when the costs of repairing or remodeling a home exceed the value of the home.

- Curable functional obsolescence – Curable obsolescence is the term for the physical deterioration of the subject property that can easily be remedied, or cured, by the new homeowner. For example, cosmetic repairs and a new coat of paint.

- Superadequacy – While it may seem counterintuitive, a property owner can over-improve their home to the extent that it lessens the resale value. For instance, a home with an indoor swimming pool may be too costly for most homeowners to maintain. The appraisal method an appraiser uses to determine the value of the home is significant. However, the appraiser may lessen the market value to account for the additional cost of maintaining or removing the over-improvement. (Source: masterclass.com)

Economic Obsolescence

In general, economic obsolescence refers to the reduction or loss of value due to external factors or outside forces. As a result, it is also commonly known as external obsolescence. Some examples of economic obsolescence indicators are increased competition, legislative changes, reduced profit margin or lower operating margin, recession, reduced market demand, or economic depression.

Economic obsolescence in real estate

Economic obsolescence in real estate is the depreciation in the market value of a property due to external factors that cannot be controlled by the owner. Common causes of economic obsolescence are things like: traffic pattern changes, zoning changes, flight pattern changes, construction of public nuisance projects like a jail or sewer treatment plant, rising crime, or job loss. Consider a thriving housing complex in close proximity to a large airport. The property is fully occupied, has a good cash flow, and inhabitants prefer to live there because of its proximity to the airport.

Now consider what would happen if the FAA chooses to modify the airport’s approach path one day. At all hours of the day and night, the new pattern places aircraft straight over the residential complex at a low height. The property owner had no say in the alteration, but they will most likely bear the repercussions in two ways. For starters, tenants are likely to vacate, resulting in increasing vacancy in the property. Second, the increased vacancies will need a reduction in rents to the point where they are viewed as a good deal, notwithstanding the airplane noise. These economic reasons, when combined, might result in a decrease in operating revenue and a decrease in property value, possibly to the point where it is regarded as economically obsolete.

Physical Obsolescence

In general, Physical obsolescence refers to the wear and tear that is evident in a tangible asset, like a machine or equipment. Over time, physical deterioration becomes visible after much use, and the output declines as a result.

Physical obsolescence in real estate

Physical obsolescence in real estate results in a fall in property value caused by physical depreciation or neglect. Deterioration of real estate assets is unavoidable over time. However, it can be managed with proactive maintenance and upkeep. Physical obsolescence occurs when maintenance obligations are ignored and the property physically deteriorates to the point of no longer being desirable. For example, consider a property owner who never replaces the air filters in the HVAC system. As a result, mold and mildew build up over time. Eventually, it can reach the point where the entire property is no longer suitable for occupancy. Clearly, this would negatively impact the property’s value. It would most likely result in lower occupancy, lower economic life, operating losses, and potential capital losses.

The question of whether physical obsolescence is curable is determined by the cost of replacement. If the cost to remedy is prohibitively expensive or cannot be recovered through increased occupancy or higher rentals, it is likely incurable. However, if the expense is minimal and recoverable, it makes economic sense to make the necessary renovations to protect the overall value.

Example of Functional Obsolescence

Consider a 1950s style house with three bedrooms and one bathroom. It is located in a gated subdivision filled with two-story houses containing five bedrooms and four bathrooms. The older house does not have the features and amenities that buyers in this market want. Therefore, it is considered functionally obsolete even if it is still in good condition and is perfectly livable. As a result, the appraised value will be negatively impacted unless it is properly renovated and upgraded.

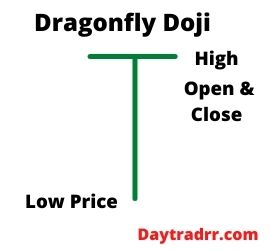

Up Next: What is a Dragonfly Doji Candlestick Pattern?

A dragonfly doji candlestick pattern forms when a trading candlestick has the same high, open, and closing prices forming a capital letter “T”

A dragonfly doji candlestick pattern forms when a trading candlestick has the same high, open, and closing prices forming a capital letter “T”

The Dragonfly Doji is typically interpreted as a bullish reversal chart pattern when it occurs at the bottom of a downtrend. Correctly identifying the Dragonfly Doji can help traders see where support and demand are located. This information can then be used with other indicators to identify a possible uptrend.

In general, a Dragonfly Doji can signal a potential reversal in price to the downside or upside, depending on past price action. It forms when the asset’s high, open, and close prices are the same. A long lower shadow suggests aggressive selling during the period of the candle. The long lower shadow implies that the market tested where demand was located and found it. However, because the price closes near the open, it shows that buyers were able to absorb the selling and push the price back up.

Following a downtrend, the dragonfly candlestick may signal a reversal and a price rise is emerging. However, when following an uptrend, it shows more selling is entering the market and a price decline could follow. In either case, the candles following the dragonfly doji need to confirm the direction. The greater the subsequent volume, the stronger the confirmation signal.