What Is a Bullish Harami?

A bullish harami is a simple candlestick chart pattern that indicates the reversal of a bearish trend in an asset or market. A smaller body on the next candle must close higher within the body of the previous day’s candle to form a bullish harami. Technical traders believe this indicates a larger possibility of a reversal.

A bullish harami is a simple candlestick chart pattern that indicates the reversal of a bearish trend in an asset or market. A smaller body on the next candle must close higher within the body of the previous day’s candle to form a bullish harami. Technical traders believe this indicates a larger possibility of a reversal.

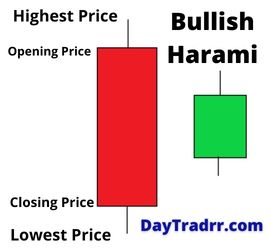

Chart-watchers believe a bullish harami is a candlestick pattern that indicates a bottom when it is preceded by a fall. It is a two-candle bullish reversal pattern. The first candle has a relatively large red body (bearish) and the second one has a smaller green body (bullish) that’s size is contained within the body of the first candle. This is also known as an inside day pattern. The upper and lower shadow lines of the second candle are short and should also fall within the body of the first candle. It’s a sign that the present downward trend (short or long term) is coming to an end, and that a positive trend reversal is on the horizon.

The illustration above depicts a bullish harami. The first red candle indicates a downward trend in the asset. Next, the subsequent green candle represents a slightly upward trend the following day. The body size of the green candle is completely contained by the body of the previous candle. Investors seeing this bullish harami may be encouraged by this pattern, as it can signal a reversal in the market.

Bullish Harami Indications

- Potential Uptrend – The opening price of the second candle is higher than the closing price of the first bearish candle. As a result, the day starts with a gap up indicating that buyers are gaining control.

- Delicate Balance – The rest of the trading session elapses with buyers and sellers trying to keep each other in check. A positive closing price indicates that buyers have kept control following the first gap up. However, there was not enough momentum to lift the stock over the previous day’s starting price. As a consequence, an inside candle appears.

Bullish Harami – A Closer Look

A bullish harami candlestick chart pattern potentially indicates that a bearish trend may be coming to end. Some investors believe a bullish harami is a good sign. As a result, they should enter a long position on the asset in question. A candlestick chart is a sort of graph or display used to exhibit the performance of an investment. It is named for the rectangular shapes used in the chart. The rectangles resemble a candle and the lines projecting from the top and bottom are its wicks. A candlestick chart depicts the price data of a stock over the course of a single day. This includes the opening, closing, high, and low prices.

Investors seeking harami patterns should start by looking at daily market performance in candlestick charts. A bullish harami does not occur without prior candles to indicate that a downward price trend is continuing. That a bearish market appears to be pushing the price lower. At this point, harami patterns can emerge over two or more days of trading. The bullish harami signal is represented by a lengthy red (Downward trending) candlestick followed by a smaller bodied green (Upward trending) doji. The body of the green doji is totally contained inside the previous body’s vertical range.

How Reliable is the Bullish Harami Candlestick Pattern?

Like all other candlestick patterns, Bullish Harami’s validity is determined by the market activity surrounding it, indicators, where it appears in the trend, and important levels of support. Please keep in mind that the pattern in itself is only an indication of a change of direction. It is by no means sufficient on its own to be used arbitrarily as an entry setup.

Entering a Bullish Harami Trade

In this case, there is a longer bearish candle from a continuing bearish trend. Next, is a second bullish candle that is smaller and fully engulfed by the previous candle’s vertical dimensions. The trading confirmation comes from a third bullish candle that closes above the close of the previous bullish candle. The Harami candlestick setup is a specific price action sequence. Always combine the Harami setup with extra price action signals and extended price targets.

- Open your trade based on Harami pattern confirmation.

- Stay in the trade for a minimum target equal to the size of the Harami setup. Hold the trade further if the price action allows.

- Apply a Stop Loss order beyond the candlewick at the closing side of the first Harami candle.

Stop Loss when Trading the Bullish Harami Formation

Harami patterns, like all other trading patterns, will never guarantee 100% success. Some Harami-inspired deals will go down in flames. As a result, you should always place a Stop Loss order on every Harami trade to minimize the possible loss. If you’re trading a bullish Harami pattern, your Stop Loss order should be placed below the bottom point of the first Harami candlestick. Recall that this is the first red candlestick in the pattern and is the lengthier downward trending candle. So, in the event of a bullish Harami candlestick pattern, the Stop Loss order should be placed below the first candle’s bottom candlewick.

Harami Candlestick Pattern – Final Words

Analysts search for efficient ways to comprehend and make decisions based on daily market performance data. As a result, technical analysts and traders will often rely on patterns in candlestick charts. The bullish harami and its alter ego, the bearish harami, are used to forecast imminent price reversals. Candlestick chart analysis provides a wide range of patterns to potentially forecast future trends. Among the basic candlestick patterns are bullish and bearish haramis. More sophisticated candlestick patterns have been identified for those seeking more insight and deeper investigation.

- Candlestick patterns are a common tool used for technical analysis.

- One of the more frequent candlestick setups in technical trading is the Harami pattern.

- The Harami formation is a two-candle pattern. The first one trends in the opposite to the second one and fully engulfs its vertical height.

- There are two types of Harami reversal patterns:

- Bullish Harami patterns typically appear at the end of bearish trends. They start with a longer bearish candle. The vertical body fully engulfs the body a second smaller bullish candle.

- Bearish Harami patterns typically appear at the end of bullish trends. They start with a longer bullish candle. The vertical body fully engulfs the body of the second smaller bearish candle.

- Harami candlestick pattern trading rules:

- Open your trades upon Harami’s confirmation. This is a third candle, which is in the direction of the reversal and closes beyond the close of the second candle.

- Place a Stop Loss order beyond the candlewick at the closing side of the first Harami candle.

- Hold the trade for a minimum price move equal to the size of the pattern. This is the length of the first Harami candlestick.

Up Next: What Is Return on Sales (ROS)?

Return on sales is a financial analysis ratio that calculates how efficiently a company is generating profits from its top-line sales revenue. It provides insight into a company’s performance by analyzing the percentage of total revenue that is converted into operating profits. As a result, ROS is used as an indicator of both efficiency and profitability. It sheds light on how effectively a company is producing its core products and services. In turn, this reflects how well its management runs the business.

Return on sales is a financial analysis ratio that calculates how efficiently a company is generating profits from its top-line sales revenue. It provides insight into a company’s performance by analyzing the percentage of total revenue that is converted into operating profits. As a result, ROS is used as an indicator of both efficiency and profitability. It sheds light on how effectively a company is producing its core products and services. In turn, this reflects how well its management runs the business.

Return on sales (ROS) is useful when evaluating a company’s operational efficiency. The metric provides insight into how much profit is being produced per dollar of sales. For example, an increasing ROS indicates that a company is improving efficiency. Conversely, a decreasing ROS could signal impending financial troubles. ROS is closely related to a firm’s operating profit margin.