What Is the Treasury Stock Method? The Treasury stock method is used to compute the number of new company shares that can be created from existing in-the-money warrants or options. The treasury stock method is an accounting procedure. Companies use it to compute the number of new shares they can […]

GWACs – What are Government-Wide Acquisition Contracts? GWACs are government-wide acquisition contracts. They let government agencies align their needs and jointly purchase contracts for goods and services. With GWACs, multiple government agencies can align their needs and purchase a contract for goods or services. As a result, GWACs allow for […]

Negative PE Ratio – What it Means A negative PE ratio (Price-to-Earnings) means that the company has negative earnings, or is losing money. While losing money is never a good thing, it is not always a bad thing either. It depends on a number of factors and requires a closer […]

Semiannually – What Is Semiannual? Semiannually describes something that is calculated, paid, reported, published, or otherwise occurs twice each year or once every six months. Biannual or semiannual simply means that something occurs twice a year. For example, a company could have company celebrations semiannually. The first is the company […]

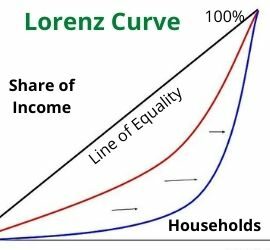

What Is a Lorenz Curve? The Lorenz curve is a graphical representation showing the distribution of income or wealth within an economy developed by Max Lorenz in 1905. The Lorenz curve is a way to measure income distribution. The curve graphs cumulative percentages of income on the Y axis. It […]

What Is a Posterior Probability? Posterior probability is the probability an event will happen after all evidence or background information has been taken into account. It is a revised probability that takes into account new available information. In Bayesian statistics, it is the revised or updated probability of an event. However, […]