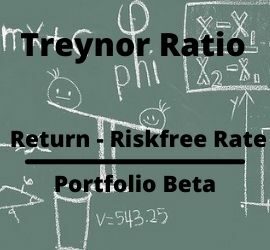

What Is the Treynor Ratio? The Treynor ratio is also known as the reward-to-volatility ratio. It measures the excess returns on a portfolio against what could have been earned on an investment with no diversifiable risk. In other words, it is a performance metric for determining how much excess return […]

Trading Basics

What Is Idiosyncratic Risk? Idiosyncratic risk is a type of investment risk that is specific to an individual asset like a particular company’s stock. It can also affect a group of related assets like a particular sector’s stocks. And, in some cases, a very specific asset class like collateralized mortgage […]

What Is Unsystematic Risk? Unsystematic risk is a risk or potential danger that is inherent to a specific company or industry. It can be greatly reduced through portfolio diversification across different industries and classes of assets. Unsystematic risk is unique to a specific company or industry. It is also referred […]

What Is a Bull Trap? A bull trap is a false signal. It refers to a declining trend in a stock, index, or other security. The reversal occurs after a convincing rally that breaks a prior support level. This scenario traps traders or investors who act on the buy signal. […]

What Is the Security Market Line? The security market line (SML) is a theoretical representation of the expected returns of assets based on systematic, non-diversifiable risk. The security market line (SML) is a line investors calculate and plot on a trading chart. It serves as a graphical representation of the […]

What are Teenies in Stock Trading? Teenies were once the smallest measure of value in stock trading. Teenies were equal to one-sixteenth of one basis point. In April 2001, the Securities and Exchange Commission ordered all U.S. stock markets to use decimalization. As a result, stock quotes switched from using […]