PG Stock – What Investors Should Know About Procter & Gamble

Procter & Gamble (PG stock) is one of the world’s largest consumer product manufacturers, with annual sales of nearly $70 billion worldwide. P&G provides branded consumer packaged goods to consumers in North and Latin America, Europe, the Asia Pacific, Greater China, India, the Middle East, and Africa. The business is divided into five divisions: beauty, grooming, health care, fabric, and home care, and baby, feminine, and family care. The Company sells products primarily through mass merchandisers, grocery stores, membership club stores, drug stores, department stores, and distributors. Also, through wholesalers, baby stores, specialty beauty stores, e-commerce, high-frequency stores, pharmacies, electronics stores, and professional channels, as well as direct to consumers in approximately 180 countries and territories. The Procter & Gamble Company was founded in 1837 and is headquartered in Cincinnati, Ohio.

Procter & Gamble (PG stock) is one of the world’s largest consumer product manufacturers, with annual sales of nearly $70 billion worldwide. P&G provides branded consumer packaged goods to consumers in North and Latin America, Europe, the Asia Pacific, Greater China, India, the Middle East, and Africa. The business is divided into five divisions: beauty, grooming, health care, fabric, and home care, and baby, feminine, and family care. The Company sells products primarily through mass merchandisers, grocery stores, membership club stores, drug stores, department stores, and distributors. Also, through wholesalers, baby stores, specialty beauty stores, e-commerce, high-frequency stores, pharmacies, electronics stores, and professional channels, as well as direct to consumers in approximately 180 countries and territories. The Procter & Gamble Company was founded in 1837 and is headquartered in Cincinnati, Ohio.

P&G Brands

Proctor & Gamble sells products under the following brands: Head & Shoulders, Herbal Essences, Pantene, Rejoice, Olay, Old Spice, Safeguard, Secret, SK-II, Braun, Gillette, Venus, Crest, Oral-B, Metamucil, Neurobion, Pepto-Bismol, Vicks, Ariel, Downy, Gain, Tide, Cascade, Dawn, Fairy, Febreze, Mr. Clean, Swiffer, Luvs, Pampers, Always, Always Discreet, Tampax, Bounty, Charmin, and Puffs.

Proctor & Gamble’s Business Segments

The Procter & Gamble Company provides branded consumer packaged goods worldwide. It operates through five segments: Beauty; Grooming; Health Care; Fabric & Home Care; and Baby, Feminine & Family Care.

- Beauty – The Beauty segment offers conditioners, shampoos, styling aids, and treatments under the Head & Shoulders, Herbal Essences, Pantene, and Rejoice brands. Antiperspirants and deodorants, personal cleansing, and skin care products are sold under the Olay, Old Spice, Safeguard, Secret, and SK-II brands.

- Grooming – The Grooming segment provides shave care products and appliances under the Braun, Gillette, and Venus brands names.

- Health – The Health Care segment offers toothbrushes, toothpaste, and other oral care products under the Crest and Oral-B brand names. Gastrointestinal, rapid diagnostics, respiratory, vitamins/minerals/supplements, pain relief, and other personal health care products are offered under the Metamucil, Neurobion, Pepto-Bismol, and Vicks brands.

- Home Care – The Fabric & Home Care segment provides fabric enhancers, laundry additives, and laundry detergents under the Ariel, Downy, Gain, and Tide brands. Air care, dish care, P&G professional, and surface care products are sold under the Cascade, Dawn, Fairy, Febreze, Mr. Clean, and Swiffer brands.

- Baby, Feminine, and Family – The Baby, Feminine & Family Care segment offers baby wipes, taped diapers, and pants under the Luvs and Pampers brands. Adult incontinence and feminine care products are under the Always, Always Discreet, and Tampax brands. Paper towels, tissues, and toilet paper are marketed under the Bounty, Charmin, and Puffs brands.

PG Stock: Annual Reports – Financials – SEC Filings

PROCTER & GAMBLE Co is incorporated in the state of Ohio. PROCTER & GAMBLE Co is primarily in the business of soap, detergent, cleaning preparations, perfumes, and cosmetics. For financial reporting, their fiscal year ends on June 30th. This page includes all SEC registration details as well as a list of all documents (S-1, Prospectus, Current Reports, 8-K, 10K, Annual Reports) filed by PROCTER & GAMBLE Co.

Since its founding in 1837, Procter & Gamble has grown to become one of the world’s largest consumer product manufacturers, with annual sales of nearly $70 billion. It operates with a portfolio of leading brands, including 21 with annual global sales in excess of $1 billion each. For example, Tide laundry detergent, Charmin toilet paper, Pantene shampoo, and Pampers diapers. In calendar 2012, P&G sold its last remaining food brand, Pringles, to Kellogg. Outside of its home market, the firm’s consolidated sales account for approximately 55% of its total, with approximately one-third coming from emerging markets.

PG Stock Dividend

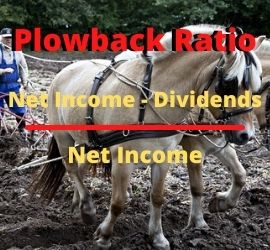

Procter & Gamble (PG stock symbol) stands out among Dividend Kings — which are S&P 500 companies that have paid and raised their dividends for at least 50 years.

P&G generates solid free cash flow, which supports ongoing dividend raises and a record-high number of share buybacks. Investors in P&G benefit from dividends because they provide a passive income stream without having to sell the stock. Also, share buybacks reduce the outstanding share count and lead to higher earnings per share. In turn, this makes P&G an all-around better value for its shareholders.

The current trailing 12-month dividend payout for Procter & Gamble (PG) as of November 28, 2022, is $3.65. The current dividend yield for Procter & Gamble as of November 28, 2022, is 2.49%.

PG Stock Forecast

The Procter & Gamble Company has issued earnings guidance for 2023. P&G reduced its fiscal 2023 all-in sales guidance range from 3% to 1% lower than the previous fiscal year. However, the company maintained its forecast for organic sales growth of 3% to 5%.

- 22 analysts offering 12-month price forecasts for Procter & Gamble Co have a median target of 147.50, with a high estimate of 170.00 and a low estimate of 122.00. The median estimate represents a -1.23% decrease from the last price of 149.33. (Source: cnn.com)

- Valuation metrics show that PG Stock may be overvalued. Its Value Score of D indicates it would be a bad pick for value investors. The financial health and growth prospects of PG, demonstrate its potential to underperform the market. It currently has a Growth Score of B. (Source: zacks.com)

- There are mostly positive signals in the chart. The Procter & Gamble stock holds buy signals from both short and long-term moving averages giving a positive forecast for the stock. (Source: stockinvest.us)

Is PG Stock a Buy, Hold, or Sell?

Few companies are as dominant or as dependable as Procter & Gamble. The company’s organic sales growth is impressive for its industry, particularly given P&G’s size. P&G has paid and increased its dividend for 66 consecutive years. Moreover, the company generates has ample free cash flow to support future dividend increases. Overall, P&G looks like a great buy for risk-averse investors who value capital preservation and income over growth.

- Procter & Gamble has received a consensus rating of Buy. The company’s average rating score is 2.64 and is based on 7 buy ratings, 4 hold ratings, and no sell ratings. (Source: marketbeat.com)

- Valuation metrics show that Procter & Gamble Company may be overvalued. Its Value Score of D indicates it would be a bad pick for value investors. The financial health and growth prospects of PG, demonstrate its potential to underperform the market. It currently has a Growth Score of B. (Source: zacks.com)

- Procter & Gamble’s business has been performing exceptionally well in 2022. For example, the company’s revenue increased a strong 5% in fiscal 2022, which ended in June. Organic sales were even better, up 7%. These are very strong numbers in the generally slow-moving consumer staples space. Earnings rose 6%. Most notably, the company was able to increase prices while at the same time increasing the number of products it sold and shifting consumers to higher-cost products. (Source: fool.com)

PG Stock Split History

Procter & Gamble stock (symbol: PG) underwent a total of 6 stock splits from 1970 until now. The most recent stock split occurred on June 21st, 2004. One PG share bought prior to May 19th, 1970 would equal 64 PG shares today.

- June 21st, 2004 – 2:1 split

- Sep 22nd, 1997 – 2:1 split

- June 15th, 1992 – 2:1 split

- Nov 20th, 1989 – 2:1 split

- Feb 22nd, 1983 – 2:1 split

- May 19th, 1970 – 2:1 split

PG Stock News

Procter & Gamble Insider exercised options and sold US$1.8m worth of stock (November 2022)

On the 8th of November, R. Keith exercised 34k options at a strike price of around US$78.52. Mr. Keith sold these shares for an average price of US$133 per share. This trade did not impact his existing holding.

- Since December 2021, Mr. Keith’s direct individual holding has decreased from 62.88k shares to 57.83k.

- Company insiders have collectively sold US$113m more than they bought. The sell-off occurred via options and on-market transactions in the last 12 months.

A high number of new directors have joined P&G (November 2022)

There are 5 new directors who have joined the board in the last 3 years. Independent Director Raj Subramaniam was the last director to join the board, commencing their role in 2022. The company’s lack of board continuity is considered a risk according to some analysts’ risk models.

Up Next: JNJ Stock – What Investors Should Know About Johnson & Johnson

Johnson & Johnson (JNJ stock) is the world’s largest and most diverse healthcare company selling health products, drugs, and medical devices. Johnson & Johnson is a holding company that engages in research and development, manufacture, and sales of a range of products in the healthcare field. The Company operates through three segments: Consumer Health, Pharmaceutical, and Medical Devices. Its primary focus is products related to human health and well-being. Its geographic areas served include the United States, Europe, Western Hemisphere (excluding the United States), Africa, Asia, and the Pacific.

Johnson & Johnson (JNJ stock) is the world’s largest and most diverse healthcare company selling health products, drugs, and medical devices. Johnson & Johnson is a holding company that engages in research and development, manufacture, and sales of a range of products in the healthcare field. The Company operates through three segments: Consumer Health, Pharmaceutical, and Medical Devices. Its primary focus is products related to human health and well-being. Its geographic areas served include the United States, Europe, Western Hemisphere (excluding the United States), Africa, Asia, and the Pacific.

Johnson & Johnson’s most significant competitive advantage is its diverse business model. It operates in three divisions: pharmaceuticals, medical devices, and consumer products. Wide diversification allows the company to withstand downturns and economic cycles. J&J has one of the most extensive R&D budgets among pharmaceutical companies. The company was founded by Robert Wood Johnson I, James Wood Johnson, and Edward Mead Johnson Sr. in 1886 and is headquartered in New Brunswick, NJ.