What Is a Futures Market?

A Futures Market is an exchange where futures contracts are traded for stocks, securities, or commodities with a set price for a future date.

A Futures Market is an exchange where futures contracts are traded for stocks, securities, or commodities with a set price for a future date.

A futures market is an auction market. Traders purchase and sell commodity and futures contracts for delivery at a later date. Futures contracts are exchange-traded derivatives. They are agreements to buy or sell a particular quantity of stock, investment, or commodity at a predetermined price at a future date. In other words, the contract locks in the delivery at a future date at a price specified today. Futures contracts are used to trade a wide range of commodities, currencies, and indexes. This provides traders with a diverse range of products. Futures contracts are a popular product among day traders since they can be bought and sold at any time the market is open until the fulfillment date.

Futures Market Examples

Trading was originally done through open outcry and the use of hand signals. Trading pits were situated in financial centers such as New York, Chicago, and London. Futures exchanges, like most other markets, have become primarily computerized in the twenty-first century. Examples of American futures markets are:

- New York Mercantile Exchange (NYMEX)

- Kansas City Board of Trade (KCBoT)

- Chicago Mercantile Exchange (CME)

- Chicago Board of Trade (CBoT)

- Minneapolis Grain Exchange (MGE)

- Chicago Board Options Exchange (CBOE)

Futures Market Overview

To comprehend what a futures market is, it is necessary to first understand the fundamentals of futures contracts. This is because futures contracts are the assets exchanged in these markets. Commodity producers and suppliers use futures contracts to try to avoid market volatility. Contracts are negotiated between these producers and suppliers and an investor who agrees to take on both the risk and reward of a turbulent market.

Futures markets, also known as futures exchanges, are places where these financial contracts are purchased and sold. Their delivery is at some agreed-upon date in the future at a fixed price at the time of the transaction. Futures markets today include the buying, selling, and hedging of more than just agricultural contracts. They include financial items as well, for example, the future values of interest rates. Contracts for future delivery, unlike other securities, can be created as long as open interest exists. The size of futures markets typically grows larger when the stock market outlook is uncertain. Their volume is larger than that of commodities markets and is an important component of the financial system. Futures market exchanges generate revenue via futures trading and trade processing. Additionally, they can charge traders and corporations membership or access fees to do business.

Futures Market Functions

- Sets terms – Exchanges set standardized contract terms, including the amount of the commodity to be delivered (the contract size), delivery months, the last trading day, the delivery locations, and acceptable qualities or grades of the commodity.

- Defines varieties and grades – The exchange specifies that different varieties and grades can be delivered at various fixed differentials (premiums or discounts) to the contract price.

- Provides liquidity – This standardization enhances liquidity by making it possible for large numbers of market participants to trade the same instrument. This liquidity makes the contract more useful for hedging, but standardization reduces the usefulness of a futures contract as a merchandising vehicle.

- Acts as a central clearinghouse – Futures trades made on an exchange are cleared through a central clearinghouse. The exchange acts as the buyer to all sellers and the seller to all buyers. When a futures contract is bought or sold, it is technically bought from or sold to the clearinghouse rather than the party with whom the transaction was executed on the trading floor or through an electronic trading platform.

- Offsets and Retires filed contracts – The contract is ultimately bought from and sold from the same party. Therefore, if a futures contract is bought and subsequently sold, the position has been offset and the contract is extinguished (Source: cftc.gov)

Futures Market – Regulations and Governing Bodies

Virtually all futures markets are registered with the Commodity Futures Trading Commission (CFTC). This is the primary U.S. regulatory organization for futures markets. International Exchanges are typically governed by the national regulatory agency of the country in which they are headquartered.

- NFA registration – Companies and individuals who handle customer funds or give trading advice must register with the National Futures Association (NFA), a self-regulatory organization approved by the Commodities Futures Trading Commission (CFTC).

- Disclosure – market risks and past performance to be disclosed to prospective customers.

- Customer accounts – customer funds to be kept in accounts separate from the firm’s own funds.

- Daily reconciliation – customer accounts to be adjusted to reflect each trading day’s current market value at the market close.

- Supervision, Controls, & Compliance – The CFTC also monitors registrant supervision systems, internal controls, and sales practice compliance programs.

Futures Market vs Futures Contracts

Futures markets are used to exchange futures contracts. A futures contract is an agreement between a buyer and seller. The contract legally defines the terms through which an asset such as a commodity, currency, or stock, will be bought or sold. Further, it spells out a specific price with specified payment terms on a specific day in the future. This is referred to as the expiration date.

A futures contract is a legally binding agreement between a seller and a buyer. However, the majority of futures contracts do not result in the delivery of the underlying commodity or asset. Instead, most traders find it more profitable to satisfy their futures market obligation by selling the contract (in the event of a purchased contract) or buying it back (in the case of a contract that was sold initially). Following that, the trader completes the actual cash deal in his or her local cash market.

Example

Commodity futures trading is common. For example, consider someone purchasing an October crude oil futures contract. In effect, they are committing to purchasing 1,000 barrels of oil at the agreed-upon price on the October expiration date specified in the contract. This is regardless of the market price at the time. Likewise, the seller agrees to sell those 1,000 barrels of oil at the agreed-upon price. Unless either buyer or seller trades their contract with another buyer or seller by that date, the original seller will provide 1,000 barrels of crude oil to the original buyer.

These transactions aren’t limited to commodities. Traders purchase futures contracts on company shares, foreign currency exchanges, index funds, and other instruments. Regardless of the product sold, both the buyer and seller of a futures contract must meet the contract’s obligations at the end of the contract term.

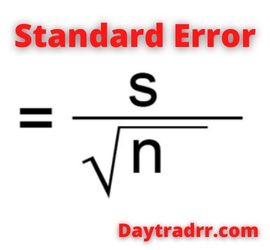

Up Next: What is the Standard Error Formula Used For?

The standard error formula measures the deviation of a sample mean from a true population mean. In finance, it is used to measure volatility and risk.

The standard error formula measures the deviation of a sample mean from a true population mean. In finance, it is used to measure volatility and risk.

The standard deviation (SD) is quite similar to the standard error (SE). Both measure spread and disbursement. The greater the number, the more dispersed the data is. Simply expressed, the two phrases are essentially equivalent. However, there is one significant distinction. The standard error is based on statistical sample data. On the other hand, standard deviations are based on actual parameters like population data. In statistics, words like the standard error of the mean and standard error of the median are used. The SE indicates how far the sample statistic such as the sample mean deviates from the true population mean. The smaller the SE, the larger the sample size. In other words, the larger the sample size, the closer the sample mean is to the population mean.