Cornering the Market – What Does “Corner the Market” Mean? Cornering the market is acquiring and holding or owning enough stocks, assets, or commodities to effectively manipulate the market price. Typically, it entails acquiring a sufficient number of a company’s shares or owning a big enough commodities position to control […]

Trading Terms

What Is Wash Trading for Cryptocurrency and Securities? Wash trading occurs when a buyer and seller conspire to deceive the market by artificially inflating the value of a stock or cryptocurrency. They do this without incurring any actual risk or altering their trading positions. The buyer and seller basically move […]

What Is “Sell in May and Go Away”? Sell in May and go away refers to the historical observation that the six-month period from November to April outperforms May through October. As a result, some traders subscribe to the technique of selling their stock investments in May, taking a summer […]

What Is a Block Trade? A block trade is an agreement between private parties to buy and sell a large number of financial securities outside public financial markets. As a result, block trades are large transactions arranged confidentially and conducted outside of public markets to reduce the impact on the price […]

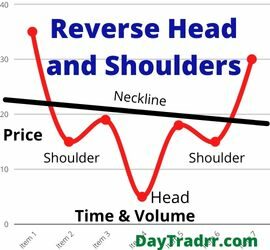

What is a Reverse Head And Shoulders Pattern? A reverse head and shoulders pattern is a technical charting indicator associated with a bullish, upward reversal of a downward price trend. The reverse head and shoulders pattern is also known as a head and shoulders bottom. The formation is similar to […]

What is a Triple Bottom Pattern? A triple bottom pattern is a bullish reversal at the end of a downtrend comprised of three lows before a breakout above the resistance level. A triple bottom pattern is a bullish chart pattern. Technical analysts define it as three equal lows followed by a breakthrough […]