What Is a Crossed Check?

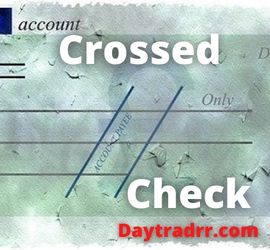

A crossed check with two parallel lines across it or in the upper left corner can not be cashed. It may only be deposited in the Payee’s account.

A crossed check with two parallel lines across it or in the upper left corner can not be cashed. It may only be deposited in the Payee’s account.

A crossed check is one that has two parallel lines crossing it. The lines may either be across the entire check or across the top left-hand corner. This two-line statement indicates that the check can only be deposited into a bank account. As a result, such checks cannot be cashed quickly by a bank or other credit institution.

A crossed check is one for which payment is not made at the bank’s counter. It is only credited to the payee’s bank account. A crossed check is created by drawing two transverse parallel lines across the check. It may include the words Account Payee or Not Negotiable. Lines are frequently drawn on the left-hand upper corner of a crossed check. In the case of a crossed check, the proceeds must be credited exclusively to the payee’s account and not to any other account. If the collecting banker credits the profits of a crossed check to another account, he or she will be exposed to a wrongful conversion of funds action and will be found negligent.

Is a crossed check valid in the USA?

Crossed checks are rarely used in the United States. Anyone attempting to deposit one is likely to encounter problems.

Crossed Check – A Closer Look

Crossed checks are often used in Mexico, Australia, and numerous European and Asian countries. The act of crossing a check communicates particular instructions to a financial institution about how the funds should be handled. Crossed checks are routinely used to ensure that a bank deposits funds solely into an actual bank account. Such receiving banks are prohibited from cashing such checks immediately upon receipt.

Because it mandates that the monies be handled through a collecting banker, this gives a level of security to the payer. While the exact formatting varies by country, two parallel lines are the most commonly used symbols. These sentences are sometimes followed by “& Co.” or “not negotiable.” In rare situations, the phrase “account payee” may also be placed on the check to express the aforementioned cashing instructions. (Source: investopedia.com)

How to Deposit a Crossed Check

When you deliver a crossed check to the bank for deposit, the process is quite similar to processing a regular check. Endorse the back of the crossed check and list the account number to which the check is being deposited. In-person, you will likely be required to provide identification in the form of a government-issued identification card. There is a key distinction between depositing a crossed check and a conventional check. With a crossed check, the bank will automatically place a hold on the check until it clears. This could take several days depending on the bank. When the check clears, the bank deposits the monies into your account and makes them available for use.

After the check clears

When the funds appear in your available balance, you may take the cash from your bank account. You are free to utilize the monies as you would the proceeds from any other check deposit. As soon as these funds are made accessible to you, they are no longer restricted. You can withdraw these monies from a bank teller or an automated teller machine. You can also use checks, your debit card, or leave the funds in your account to set up automated payments.

Crossed Check vs Uncrossed Check

Receiving banks are required to comply when negotiating crossed checks. Otherwise, the institution may be held liable for breach of contract by the consumer who wrote the check. If the payee did not have sufficient funds to cover the check’s cashing, the bank may be held liable for any resulting damages. An open check, also known as a bearer check, is any check that has not been crossed. These checks can be cashed at the teller counter and the monies transferred straight to the payee.

Once a check is crossed, it’s impossible for the payee to uncross it. Furthermore, such crossed checks are considered non-transferable, meaning they cannot be signed over to a third party. The only action permitted is for the payee to deposit the check in an account that the payee holds in their own name. Although the payee cannot uncross checks, the payer can do so, by writing “Crossing Canceled” across the front of the check, but this activity is generally discouraged because it eliminates the protection the payer originally set in place. (Source: ibid)

Can a Crossed Check be Uncrossed?

The crossing created on the cheque cannot be removed by the recipient. Furthermore, there is no way for the cheque to be transferred to a third party or cashed over the counter by the beneficiary. A cheque of this type must be deposited immediately into an account in the name that appears on the payee line of the cheque.

According to the law, once you have written a check, only you have the ability to ‘uncross’ it. This is done by writing CROSSING CANCELLED right above the crossing and then signing it. However, taking this step is not advised because it loses your legal protection against loss and fraud. When in doubt, check the rules and relevant data that are always presented on bank websites for the convenience of clients and new account holders.

Up Next: What Is Autotrading?

Autotrading stocks and financial instruments is a method of entering and exiting trades using a program or platform that executes trading algorithms with pre-set rules.

Autotrading stocks and financial instruments is a method of entering and exiting trades using a program or platform that executes trading algorithms with pre-set rules.

Autotrading is a pre-set trading plan where buy and sell orders are automatically placed based on an underlying algorithm or program. These orders are automatically placed when the trade conditions in the underlying system or program are met.

Automated trading allows investors to participate in financial markets utilizing pre-programmed rules to enter and exit deals. As the trader, you can customize these rules by combining your personal, in-depth technical analysis with positional instructions. For example, when to open orders, trailing stops, and guaranteed stops. Auto trading allows traders to execute multiple trades in a short period of time. It also removes emotion from trading decisions. This is due to the fact that all of the rules of the trade are already embedded into the pre-specified parameters. As Artificial Intelligence (AI) improves, there are even pre-determined algorithms to follow trends and trade accordingly.